41+ Best personal loan lenders for bad credit

Basic housing sustenance allowance count toward qualifying. Personal finance may involve paying for education financing durable goods such as real estate and cars buying insurance investing and saving for retirement.

![]()

Positive Negative Reviews Make Money Earn Easy Cash By Free International Calls App Ltd 19 App In Gift Cards Lifestyle Category 9 Similar Apps 530 380

The average loan amount is on the low end however at 13500 according to data.

. Loan Amounts Terms. A mortgage loan is a very common type of loan used by many individuals to purchase residential or commercial property. We Spend Over 100000 per Year for High-Quality Content.

The Best Health Insurance Companies of 2022. 24 of loan amount Comparison rate 1256 - 4150. For example as of this writing the average interest rate on a credit card is 1949 while the average rate on a personal loan is 941.

Many lenders have minimum credit score requirements in the mid-600s but most give their best rates to borrowers with credit scores of at least 700. Petal evaluates your creditworthiness based on your banking history not your credit score. Best Personal Loans for Bad Credit of September 2022.

Continue reading Get 300 to Write for. Theres no minimum credit scoreNo other mortgage offers this benefit but these loans are only open. Pre-qualify for your personal loan today.

Personal finance may also involve paying for a loan or other debt obligations. Rates start as low as 5 for qualified borrowers. ElitePersonalFinance is a highly trusted finance blog with content from some of the best in the finance sector.

We are always looking for talented writers who want to share their guest posts on our site. Facebook Twitter Instagram Linkedin. Before taking out a personal loan with this company its a good idea for.

VA loans have the most generous credit score requirements. Know your credit score. VA Loan Credit Score Requirements.

Looking for a Personal Loan. Federal credit union personal loan rates may be low for bad-credit borrowers. Why Upstart is the best personal loan for little credit history.

Getting a bad credit home loan with a low credit score. Direct debit dishonour fee. There are multiple credit scoring models but most lenders use FICO Scores created by the Fair Isaac Corporation.

That may not be as easy as it would be with other cards on this list. Most lenders look at back-end DTI ratio. The average personal loan interest rate has risen from 1041 percent at the beginning of May 2022 to 1060 percent as of July.

While your credit score is just one factor mortgage lenders will consider when youre buying a home with bad credit its weighed heavily because it represents your risk to lenders. Personal finance is defined as the mindful planning of monetary spending and saving while also considering the possibility of future risk. Average interest rates are 25 with a VA or USDA loan.

And all people who understand finances can write for us. Credit unions and online lenders offer personal loans for bad credit credit scores below 630. Debt-to-income ratio is around 41.

Most lenders require a minimum credit score of 580 and a 35 down payment for an FHA loan but you could qualify with a credit score between 500 and 579 and a 10 down payment. The Petal 1 No Annual Fee Visa Credit Card is the best bad credit option if you qualify. That difference should allow you to pay the balance down.

The lender usually a financial institution is given security a lien on the title to the property until the mortgage is paid off in full. A secured loan is a form of debt in which the borrower pledges some asset ie a car a house as collateral. If you are new to credit or rebuilding credit youll have a chance.

Compare personal loans from online lenders like SoFi Marcus and LendingClub. Bad credit borrowing. Prosper personal loans are available in amounts between 2000 and 40000.

Prime borrowers with a credit score between 661 and 780 received an average APR of 348 for new loans and 541 for used loans while nonprime borrowers with credit scores between 601 and 660. These Lenders Have the Best Options as of September 2022. Lenders have to explain why they approve any loan above a 41 limit.

Each lender decided based on a variety of factors for each veteran.

7 Debt Payoff Challenges Speed Up Your Debt Free Plans

Understanding Money By Ashley Lisa Ebook Scribd

Mlm Facebook Posts That Work In 2022 41 Post Ideas Matt Zavadil

How To Get Better At Managing Money This Will Change Your Life

Free 41 Printable Checklist Samples Templates In Ms Word Pdf Excel

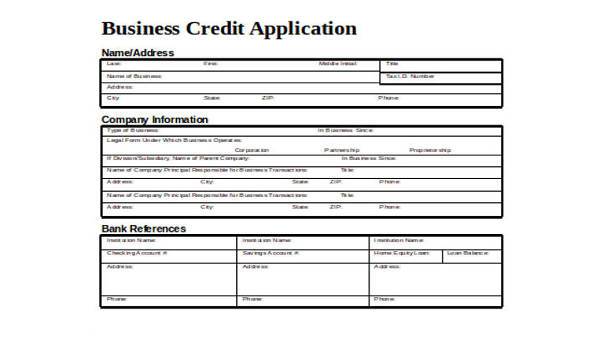

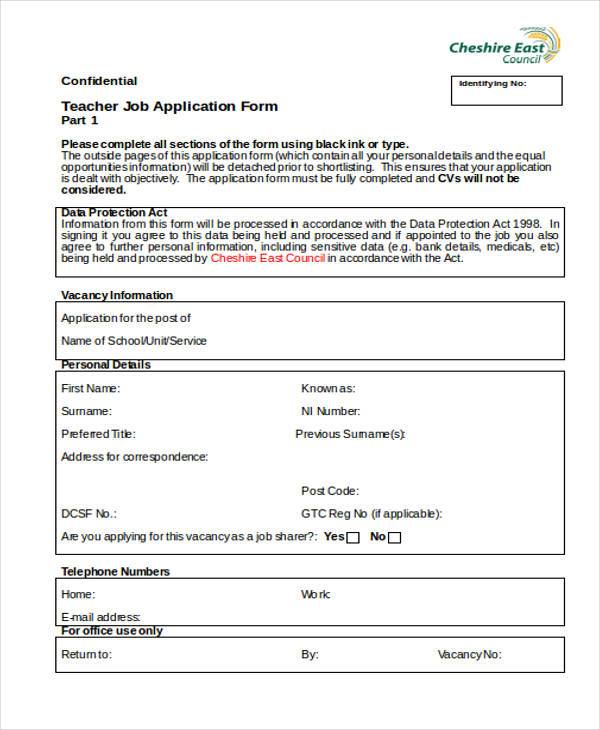

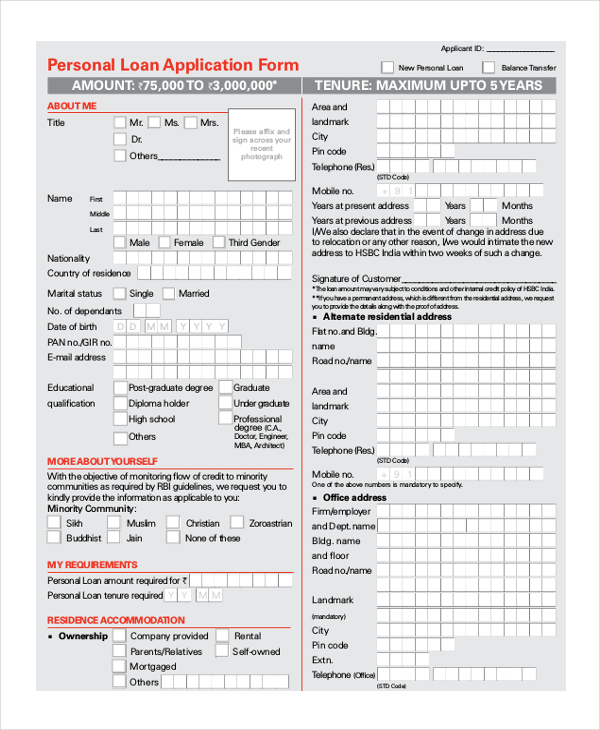

Free 41 Application Forms In Ms Word

Mlm Facebook Posts That Work In 2022 41 Post Ideas Matt Zavadil

Free 41 Application Forms In Ms Word

Free 41 Application Forms In Ms Word

2

41 Free Money Management Courses Budgets Debt Investment Etc

Suze Orman Gives Dave Ramsey The Financial Smackdown Whose Side Are You On

2

Free 13 Sample Loan Application Forms In Pdf Ms Word Excel

Intended For Unhappy Customers Of New And Used Car Dealership This Complaint Letter Requests Action And Compensation For A Bad Lettering Complaints Dealership

Joe

Joe